Last Updated on January 3, 2026 by Galaxy World

The Government of the Punjab Finance Department issued the latest notification, Clarification on Admissibility LPR on Retiring Pension Punjab. This notification guides the Revised Leave Rules, 1981, particularly in cases of superannuation and voluntary retirement, and explains when LPR encashment is admissible or not.

Clarification Admissibility LPR on Retiring Pension Punjab

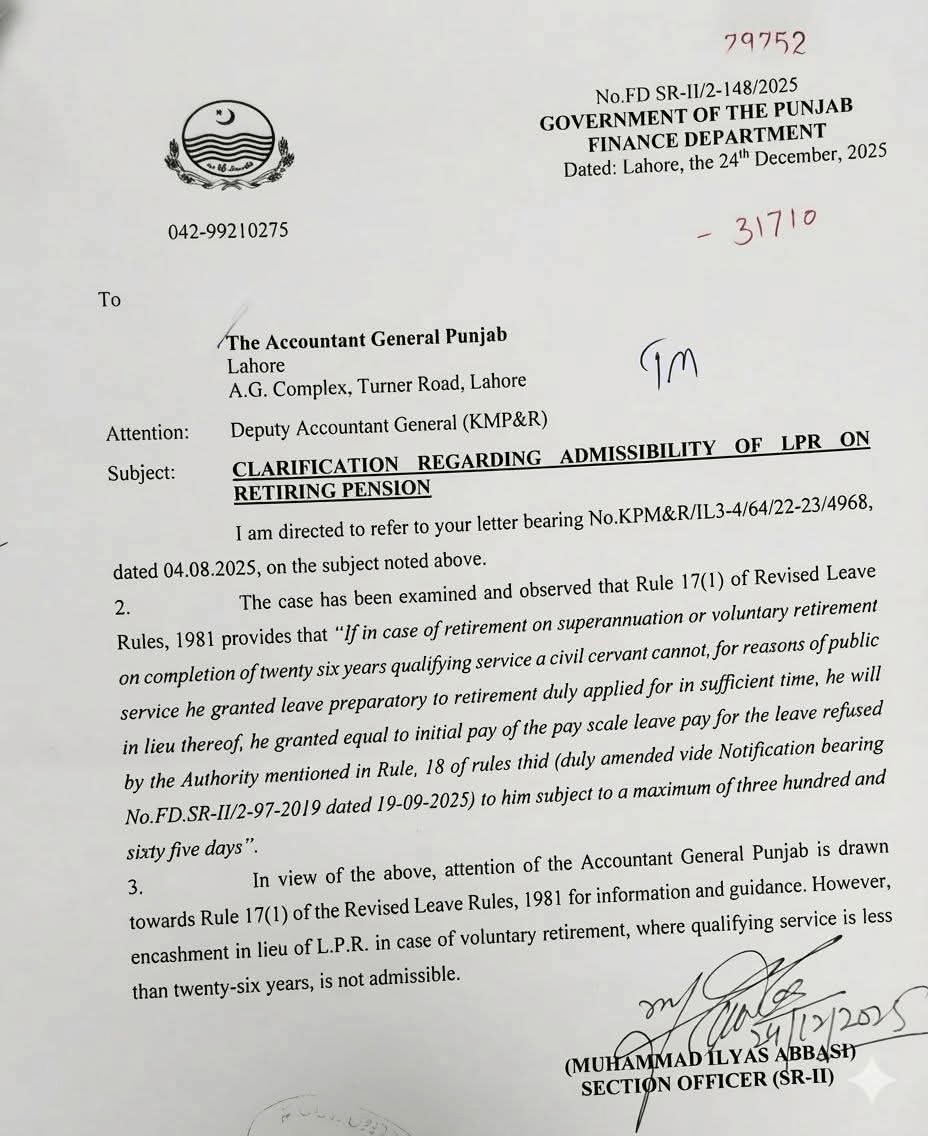

Notification No: No.FD SR-II/2-148/2025 dated 24-12-2025

Punjab clarifies LPR rules for retiring government employees

As per the Notification of the Finance Department, Punjab, I am directed to refer to your letter bearing No.KPM&R/IL3-4/64/22-23/4968 dated 04.08.2025, on the subject noted above.

The case has been examined and observed that Rule 17(1) of Revised Leave Rules, 1981 provides that “If in case of retirement on superannuation or voluntary retirement on completion of twenty six years qualifying service a civil servant cannot, for reasons of public service he granted leave preparatory to retirement duly applied for in sufficient time, he will in lieu thereof, he granted equal to initial pay of the pay scale leave pay for the leave refused by the Authority mentioned in Rule, 18 of rules thid (duly amended vide Notification bearing No.FD.SR-II/2-97-2019 dated 19-09-2025) to him subject to a maximum of three hundred and sixty five days”.

In view of the above, the attention of the Accountant General, Punjab, is drawn towards Rule 17(1) of the Revised Leave Rules, 1981, for information and guidance. However, leave encashment instead of L.P.R. in case of voluntary retirement, where qualifying service is less than twenty-six years, is not admissible.