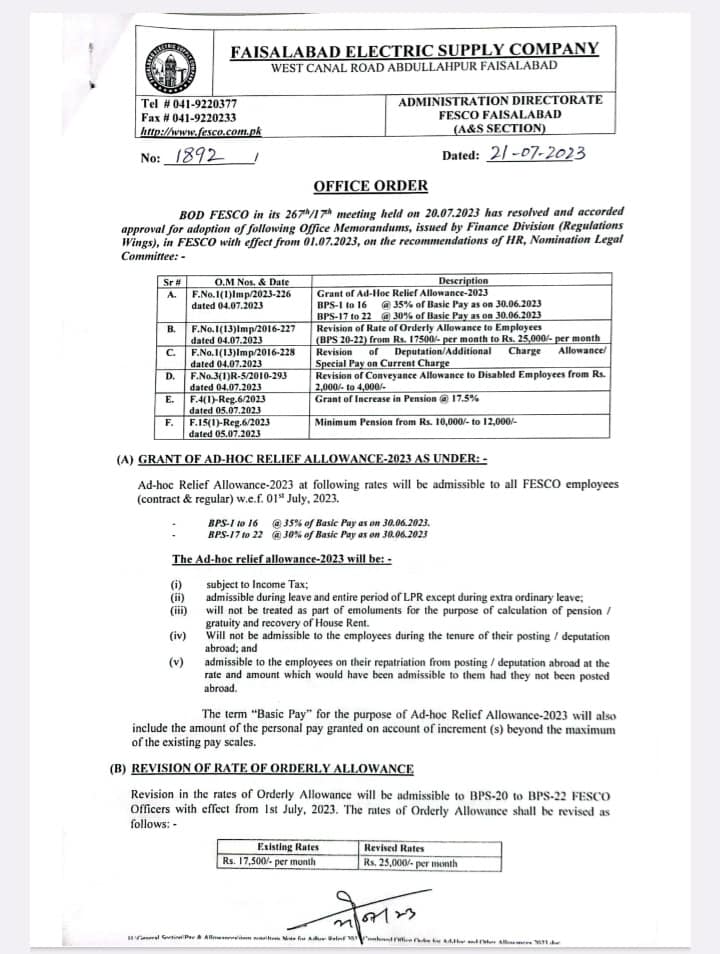

Faisalabad Electric Supply Company issued a Notification on 21-07-2023 in connection with ARA-2023 @ 35% / 30%, Pension @ 17.5% and Other Allowances FESCO. The BOD FESCO increased/granted the following pay and allowances with effect from 1st July 2023:

ARA-2023 @ 35% / 30%, Pension @ 17.5% and Other Allowances FESCO

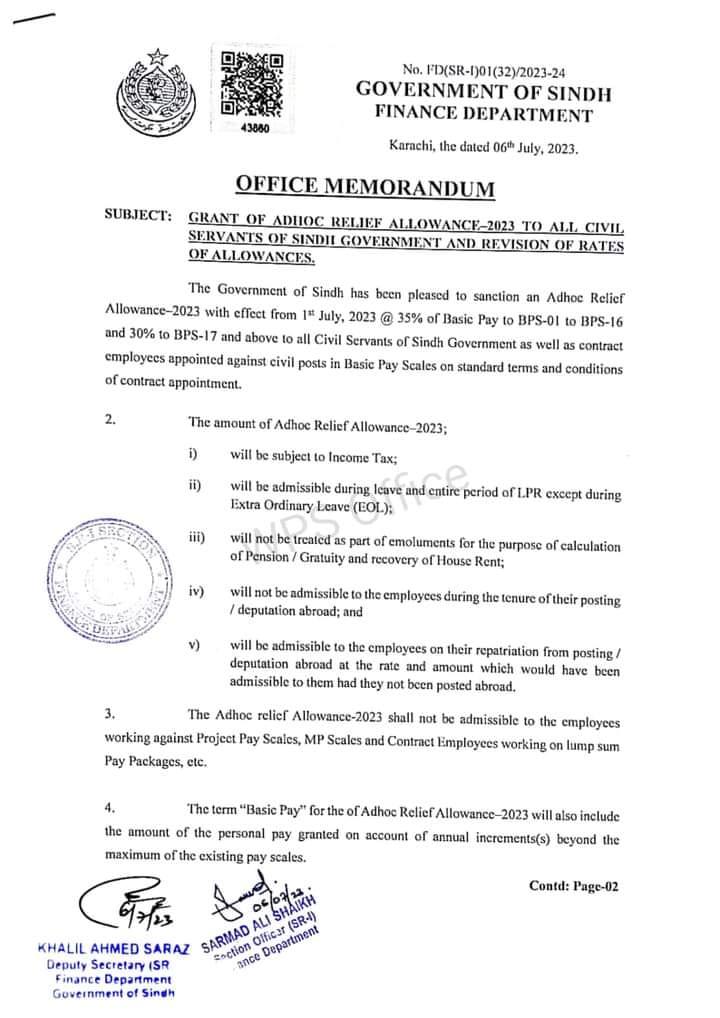

- Adhoc Relief Allowance 2023 @ 35% (BPS-01 to BPS-16), 30% (BPS-17 to BPS-22)

- Increase Pension 2023 @ 17.5% of Net Pension

- Revision of Rates of Orderly Allowance from 17000/- to 25000/- per month

- Revision of Deputation/Additional Charge Allowance etc

- Increase in Conveyance Allowance (CA) for disabled employees

- Enhancement in minimum pension 2023

Revising Rates in Allowances and Increase in Adhoc Relief Allowance FESCO Pakistan

Faisalabad Electric Supply Company (FESCO) issues a notification that shows the approval of the adaptation of some office memorandums related to Adhoc Relief Allowance 2023:

-

- 35% increase for BPS-01 to BPS-16

- 30% increase for BPS-17 to BPS-22 and above

- Revising rates of Orderly Allowance from. Rs.17500/- per month to Rs.25000/- per month. (BPS-20 to BPS-22).

- Grant of increase in Pension at 17.5%.

- Minimum Pension increases from Rs.10,000/- per Month to Rs.12,000/- per month.

- Revise Deputation/Additional Charge Allowance.

Grant of Adhoc Relief Allowance, 2023

According to the notification the new Adhoc relief allowance 2023 is admissible to all FESCO employees. All contract or regular employees serving in this department are eligible to receive this allowance @30% to 35% increase. They Will receive this allowance on the basis of their basic pay scales. The finance department will add this additional value from the first of July 2023 on a monthly basis:

| Sr.No | Name of Post | Basic Pay Scale | Increase of Adhoc Relief Allowance |

| 1. |

Adhoc Relief Allowance |

BPS-01 to BPS-16 | 35% |

| 2. | BPS-17 to BPS-22 to above | 30% |

General Terms And Condition For Admissibility of ARA Allowance 2023

- The ARA allowance 2023 is admissible subject to income tax.

- It is admissible during leave and the entire period of LPR. This doesn’t include the duration of Extraordinary Leaves.

- It is not admissible or treated as part of an emolument. Not either for the purpose of calculation of pension and gratuity and recovery of home rent.

- It is also not as admissible to the employees during the tenure of their posting or deputation abroad.

- It is admissible to the employees on their repatriation from posting or deputation abroad. For this, it is admissible at the rate and amount when they were not deputed abroad but still working in Pakistan.

- The term Basic Pay for the purpose of it ARA allowance 2023 also includes the amount of Personal Pay.

Provision of Rate of Orderly Allowance

The government of Pakistan also approves the revision in the rates of Orderly Allowance. Device rates of Orderly Allowance are revised on a monthly basis:

| Sr.No | Existing Rates | Revised Rates |

| 1. | Rs.17000/- | Rs.25000/- |

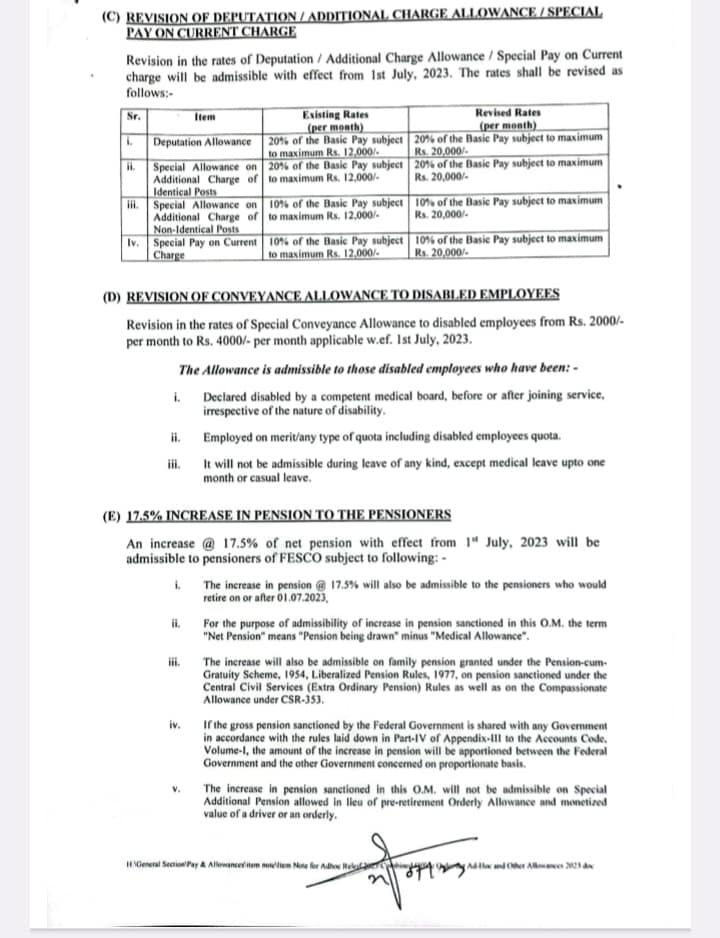

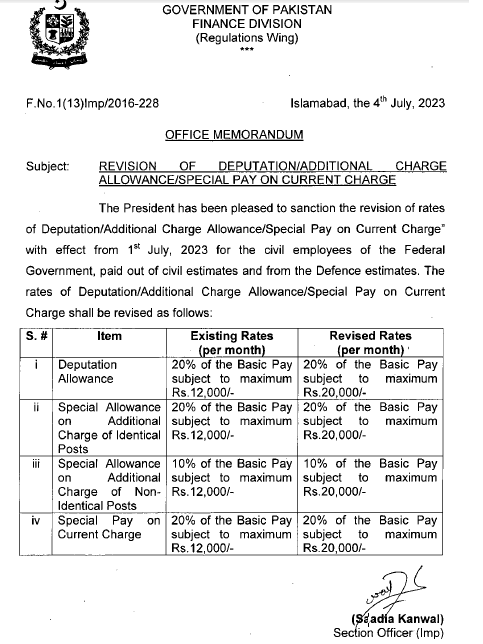

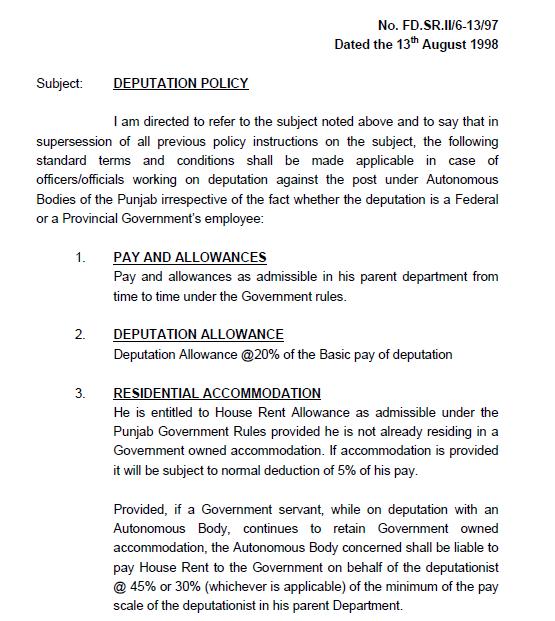

Revision of Deputation Additional Charge Allowance Special Pay on Current Charge

The government of Pakistan also revises the Rates of Deputation Allowance, Additional Charge Allowance, or Special Pay on Current Charges. Their new rates are admissible with effect from the first of July 2023.

| Sr.No | Allowance / Pay | Existing Rates | Revised Rates |

| 1. | Deputation Allowance | 20% of the basic Pay of Subject to Maximum Rs.12,000 | 20% of the basic pay Subject to Maximum Rs.20,000 |

| 2. | Special Allowance on Additional Charge of Identical Post | 20% of the Basic Pay Subject to Maximum Rs. 12,000 | 20% of the basic Pay Subject To Maximum Rs. 20,000 |

| 3. | Special Allowance On Additional Charge Of Non-identical Posts | 10% of Basic Pay Subject to Maximum Rs. 12,000 | 10% of the Basic Pay Subject to Maximum Rs. 20,000 |

| 4. | Special Pay on Current Charge | 10% of the basic pay safe Jack to maximum Rs. 12,000 | 10% of the basic face object to maximum Rs. 20,000 |

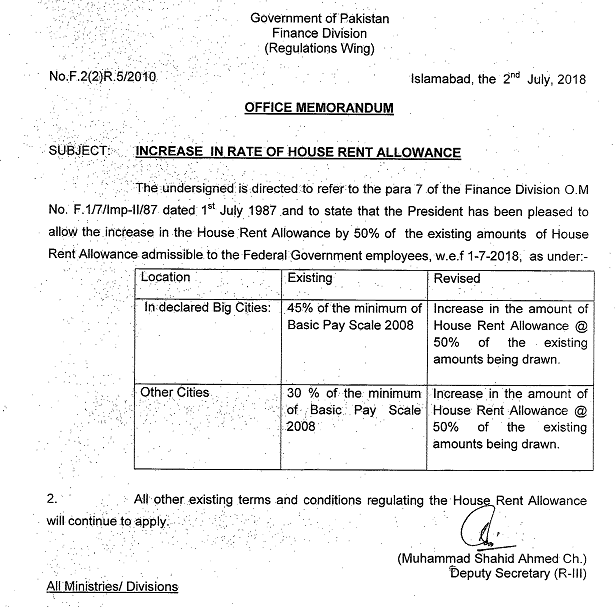

Revision of Conveyance Allowance for the Disabled Employees

In order to assist the disabled employees who are working in the public departments. The government also increases the conveyance allowance for these specially-abled employees. They were facing a lot of conveyance issues in order to reach their offices in time or come back home. Many of them hire special conveyance who charge them high fares. So, the government also decides to provide them relief and revises the conveyance allowance for these especially able employees. Government increases their conveyance allowance from Rs.2000 per month to Rs. 4000 per month. The new rates are applicable with effect from the first of July 2023.

Terms and conditions Admissibility of Revised Rates

According to the notification the new conveyance allowance rates for disabled employees are admissible on the following conditions:

- The employees are eligible if any competent medical board declares them disabled before or after joining the service.

- Employees are also eligible if they are employed on a merit basis. Or they get their service on disability quota.

- It is not admissible during the leave of any kind. It does not include Medical Leaves of up to one month or casual leaves.

17.5% Increase in Pension the Pensioners

The government of Pakistan increases the rate of Pension by 17.5% with effect from the first of July 2023.

17.5% Percent increase Is in the pension of all those government employees who have served the FESCO Pakistan. As many of the pensioners are feeding their families as a single source of income. They are managing their expenses in this inflationary era. The government wants to support them also after their service. Therefore, the government decides and announces a 17.5% increase in the pension. Although pensioners receive these additional values from the first of July 2023 on a monthly basis.

Conditions for the Pensioners

- The increase in pension is admissible to the pensioners who expect their retirement on or after the first of July 2020.

- The term Net Pension means the pension drawn without medical allowances. As the medical allowances are not included.

- The increase is also admissible on family pension under Pensioner Gratuity Scheme 1954.

- If any of the government employees receive a pension from the federal government. And shares it with any other government in accordance with the rules in Part-IV, Appendix III to the accounts code Volume-I. Then both governments will share this increase proportionately.

- It is not Admissible on Special Additional Pension.

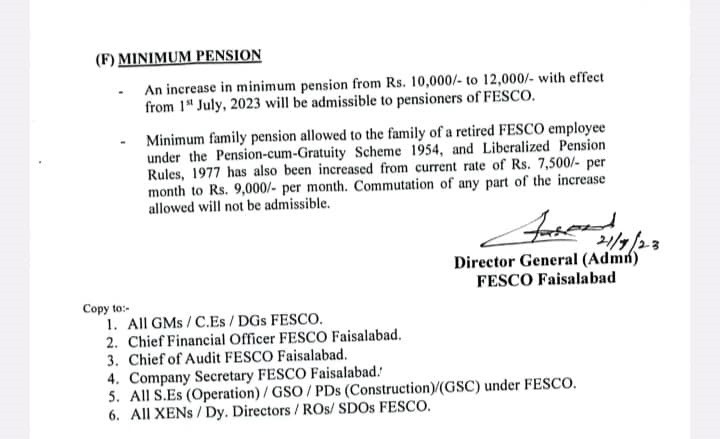

Minimum Pension 2023

- The government of Pakistan increases the minimum pension 2023 amount with effect from.1st July 2023. It adds Rs.2000 and increases it from Rs.10,000 to 12,000.

- Minimum Family Pension to the family of a retiree FESCO employee under the Pension Gratuity Scheme 1954 is Rs.7500/-. But after the increase, it becomes Rs.9000/-

| Sr.No | Existing Rates | Revised Rates |

| 1. | Rs.7500/- | Rs.9000/- |