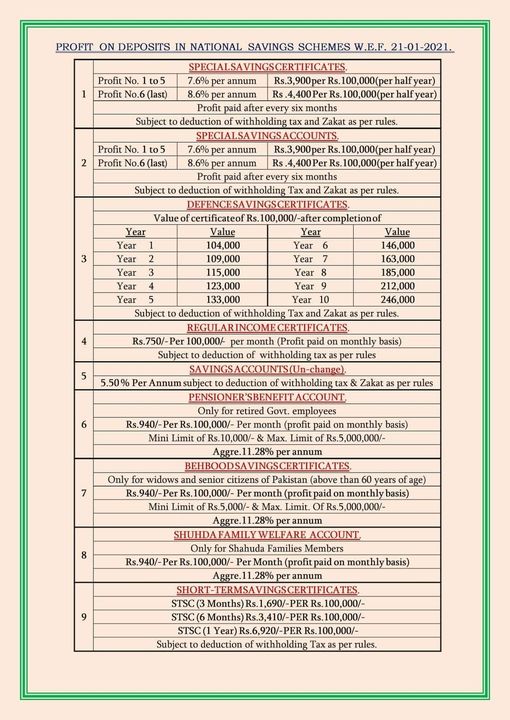

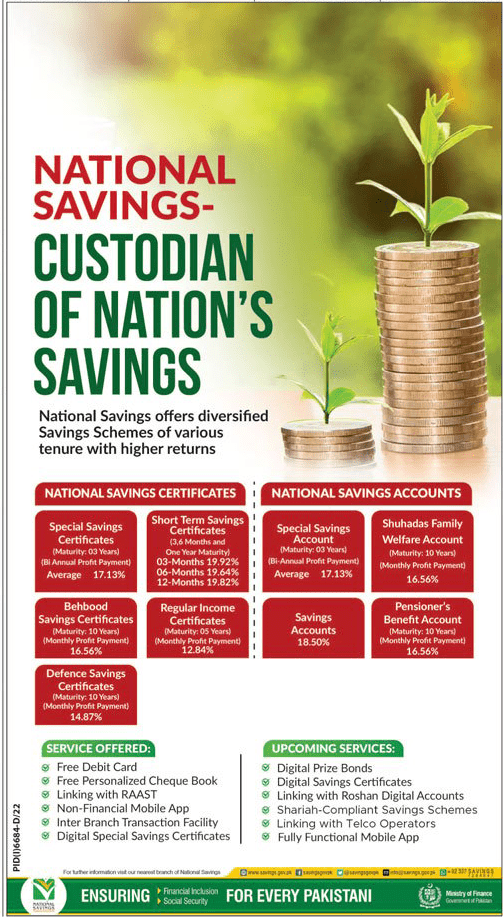

For the information of the readers, Revised Rates National Savings Schemes wef 25th March 2021 has been issued. The last time, NS changed the rates on 21-01-2021. The details are as under:

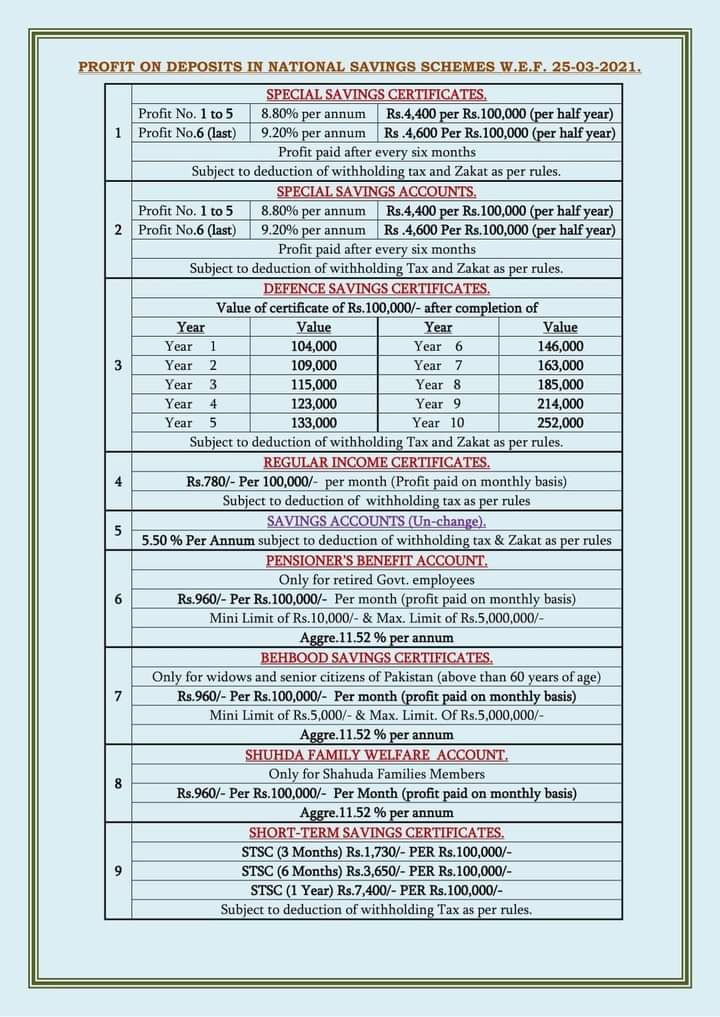

Revised Rates National Savings Schemes wef 25th March 2021

| 1. | Special Savings Certificates.

|

|||||||

| Profit No. 1 to 5 | 8.80% per annum | Rs.4,400 per Rs.100,000 (per half-year) | ||||||

| Profit No. 6 (last) | 9.20% per annum | Rs.4,600 per Rs.100,000 (per half-year) | ||||||

| Profit paid after every six months | ||||||||

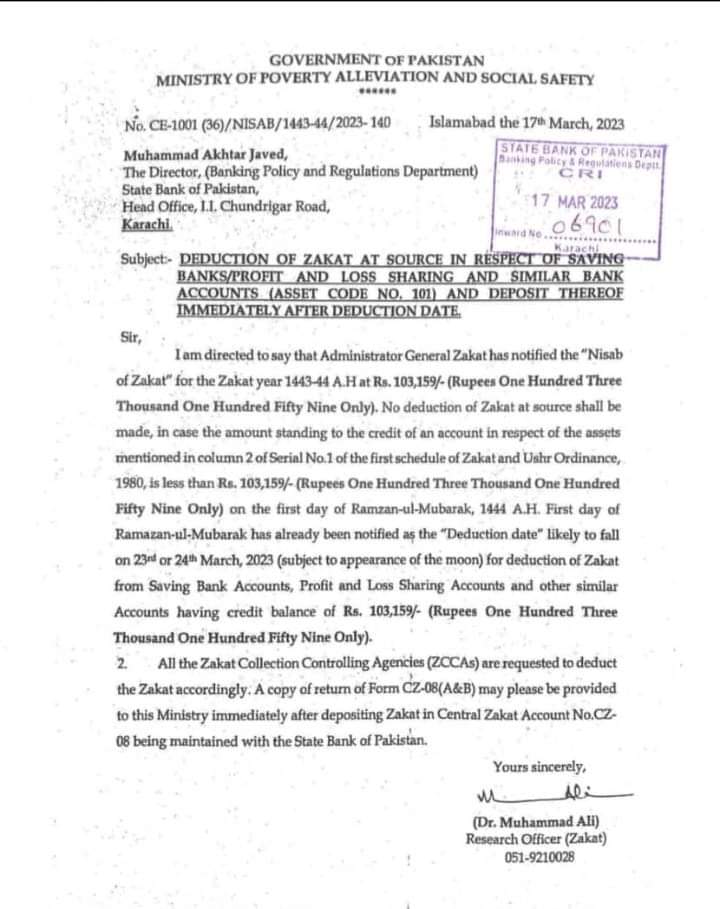

| Subject to deduction of withholding tax and Zakat as per rules. | ||||||||

|

2. |

Special Savings Accounts | |||||||

| Profit No. 1 to 5 | 8.80% per annum | Rs.4,400 per Rs.100,000 (per half-year) | ||||||

| Profit No. 6 (last) | 9.20% per annum | Rs.4,600 per Rs.100,000 (per half-year) | ||||||

| Profit paid after every six months | ||||||||

| Subject to deduction of withholding tax and Zakat as per rules. | ||||||||

|

3. |

Defence Savings Certificates. | |||||||

| Value of certificate of Rs.100,000/- after completion of | ||||||||

| Year | Value | Year | Value | |||||

| Year 1 | 104,000 | Year 6 | 146,000 | |||||

| Year 2 | 109,000 | Year 7 | 163,000 | |||||

| Year 3 | 115,000 | Year 8 | 185,000 | |||||

| Year 4 | 123,000 | Year 9 | 214,000 | |||||

| Year 5 | 133,000 | Year 10 | 252,000 | |||||

| Subject to deduction of withholding Tax and Zakat as per rules. | ||||||||

|

4. |

Regular Income Certificates | |||||||

| Rs.780/- Per 100,000/- per Month (Profit paid on monthly basis) | ||||||||

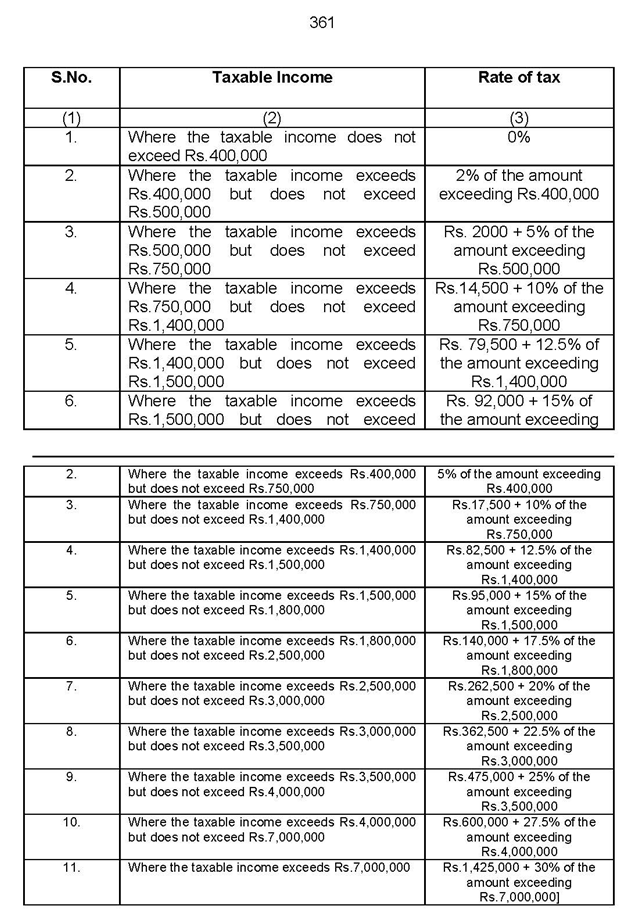

| Subject to deduction of withholding tax as per rules.

|

||||||||

|

5. |

Savings Accounts (Un-Change). | |||||||

| 5.50% Per Annum subject to deduction of withholding tax & Zakat as per rules | ||||||||

|

6. |

Pensioner’s Benefit Account. | |||||||

| Only for retired Govt. employees | ||||||||

| Rs.960/- Per Rs.100,000/- Per Month (Profit Paid on monthly basis) | ||||||||

| Mini Limit of Rs.10,000/- & Max. Limit of Rs.5,000,000/- | ||||||||

| Aggre.11.52% per annum | ||||||||

|

7. |

Behbood Savings Certificate | |||||||

| Only for widows and senior citizens of Pakistan (above 60 years of age) | ||||||||

| Rs.960/- Per Rs.100,000/- Per month (Profit paid on monthly basis) | ||||||||

| Mini Limit of Rs.5,000/- & Max. Limit. Of Rs.5,000,000/- | ||||||||

| Aggre.11.52% per annum | ||||||||

|

8. |

Shuhda Family Welfare Account. | |||||||

| Only for Shahuda Families Members | ||||||||

| Rs.960/- Per Rs.100,000/- Per month (Profit paid on monthly basis) | ||||||||

| Aggre.11.52% per annum | ||||||||

|

9. |

Short–Term Savings Certificates. | |||||||

| STSC (3 Months) Rs.1,730/- Per Rs.100,000/- | ||||||||

| The STSC (6 Months) Rs.3,650/- Per Rs.100,000/- | ||||||||

| STSC (1 Year) Rs.7,400/- Per Rs.100,000/- | ||||||||

| Subject to deduction of withholding Tax as per rules. | ||||||||

Special Thanks to Mr. Zahid Khan who sent the copy of the Notification of Revised Rates National Savings Schemes with effect from 25-03-2021.

You may also like: Provisional Payment to Sub-Ordinate Judiciary